The Binary 0-100 option contract is an interesting new trading option developed by, and exclusive to Anyoption. We recently had the opportunity to try trading with these contracts while doing a new Anyoption review for 2014. We enjoyed trading with these contracts and with the popularity of fast-paced trading right now we thought it was probably worth a share. These contracts were developed especially for fast-paced traders, and can offer returns of up to 10x your investment, or 1000%.

Trading Anyoption Binary 0-100 Options

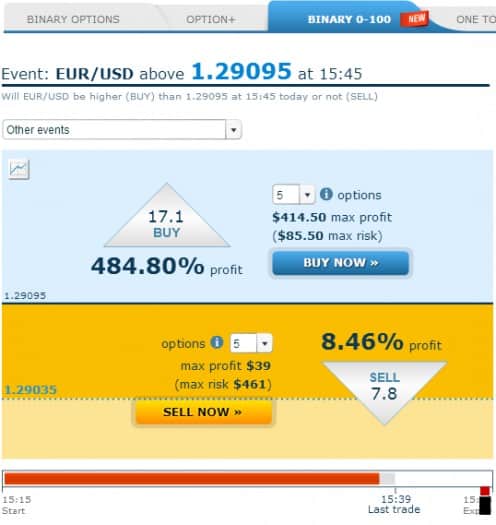

So, how exactly do these unique Anyoption 0-100 options contracts work? The Binary 0-100 contracts are based on “Events” which are automatically generated by the Anyoption system. The system generally generated dozens of these “events” each day. An “event” in this case is simply a proposition. Will the price of asset X be above level Y by time Z? If your answer is yes, then you would purchase the option contract. If your answer is no, then you would “sell” the option contract (this is just the same as the difference between purchasing a call or a put option). The potential return on these options is always $100. It is the amount which you will be risking that changes.

Purchasing Contracts:

When you believe that the chosen event will indeed occur then you will be purchasing, or buying the Anyoption 0-100 contracts. When you are buying contracts then in this case you are obviously risking the purchase price of the contracts, multiplied by the number of contracts bought. And how much the contracts cost is also what determines the potentials returns. Your profit for a winning trade will be (100 – Cost) * # Contracts Purchased. Let’s say you purchase 10 contracts on the S&P500 index for $10 each, getting you into the trade for $100 even. Now let’s assume the trade finishes ITM and plug these numbers into our little equation. (100 – 10) * 10 = 90 * 10 = $900 Net Profit. A return of 1,000% on investment!

Selling Contracts:

When you believe that the chosen event will not occur, however, then things will work a little bit differently. In this context “selling” is really just another way of saying purchasing a put option. When selling these contracts, the amount taken from your account balance is the difference between the selling price and 100, times the number of contracts sold. So this still works out to be (100 – Cost) * # Contracts Sold. For another quick example let’s say you’re selling Anyoption 10 contracts at $75 each, ($100 – $75) * 10 = $250 Risked. Your potential returns, on the other hand, are always $100 * # contracts sold. So our profit would be $1,000 – $250 Cost = $750 Net Profit, or 400% return rate.

Really not very difficult when all is said and done. We got the hang of trading them in no time flat, and have had a lot of fun with trying to develop our very own trading strategies for these new contracts. There is one last important feature of these options we need to talk about briefly: their flexibility. One of the cooler parts about trading binary 0-100 options is that you can buy and sell the contracts at will. You can trade both sides of the contract as much as you want, buying and selling your contracts as price fluctuates, all the way up until five minutes before expiry. This allows for “scalping” like strategies, as well as lots of other interesting trading strategies. Very cool.