Ladder binary options are an interesting new contract type that offer a unique risk/reward profile and trading opportunities. These options are quite different from any other kind of binary option contract but are still relatively easy to learn and use. They are, however, currently only offered by a small handful of brokers (we will cover a couple of the best ones at the end of the post) and there is not much information about them out there. Hopefully we can contribute to rectifying this at least a little bit with this article.

Definition of Ladder Binary Options

An option contract that locks-in gains as the underlying asset price reaches predetermined levels (or “rungs” on the ladder), returns rising with each step up. This guarantees at least some profit even if the asset price ends up declining back below those levels before expiry (Source: investopedia.com).

This new type of binary option contract was first introduced to the market by IG Markets, a predominantly CFD (Contracts For Difference) and forex broker that offers some binary trading. Odd that it came out of there but that’s what happened so there you go. While these options have been gaining in popularity they are still relatively little-known and not very widely available at all yet. Obviously bland definitions only get us so far in understanding what these option really are and how they are traded though so let’s get down to business.

The fact is that every broker who does offer these options handles them somewhat differently and we can’t cover every variation in this article. What we can do, however, is show you how they are generally structured and traded. Any variations from what is described here should be relatively minor.

What Are Ladder Options?

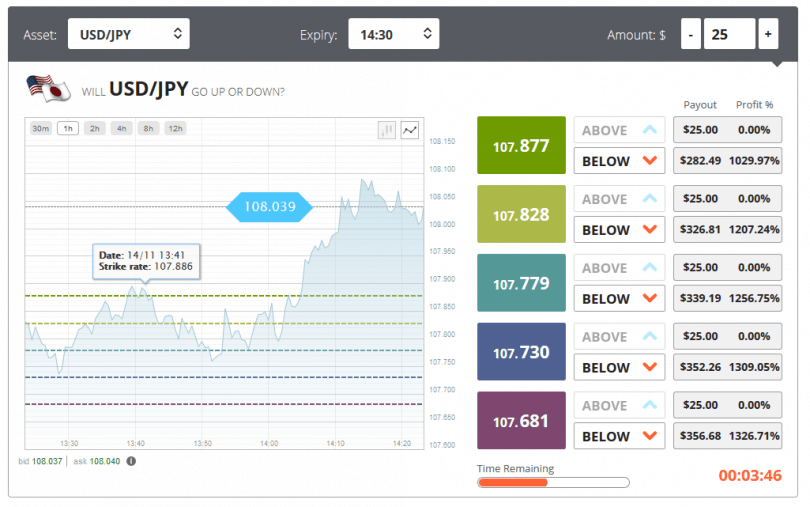

Starting with the basics and picking up where the definition left off, a Ladder binary option is a type of binary option contract in which you are presented with a range of price levels at equal intervals (ladder rungs), combined with various expiry choices. And, of course, Call or Put options. Sound confusing? It does to me. Luckily, it isn’t actually as confusing as it sounds.

Example Ladder Binary Options Trade

For our hypothetical example trade let’s assume that we are bullish on Google overall, and expect a rise today specifically, thanks to a positive earnings report after market close yesterday. Prior to market open the price of Google stock is $1,123.00 and we decide to open a position using the ladder binary options contract offered by our broker.

The first thing we will have to do is choose an expiry time. We want to give it some time to act so we choose the latest expiry for the day at 23:00 GMT. Once we choose our expiry the fields showing your broker’s offered return rates will be populated. In our example we would have something that looked like the following.

Google – Above/Below @ 1,138.00 – 470%/07% Return

Google – Above/Below @ 1,133.00 – 321%/18% Return

Google – Above/Below @ 1,128.00 – 175%/56% Return

Google – Above/Below @ 1,123.00 – 78%/124% Return

Google – Above/Below @ 1,118.00 – 23%/276% Return

(The 1st # being the return for Above, the 2nd for Below)

This table is roughly what we might be presented with given the above outlined parameters. Now we just choose our trade(s) based on the offers from our broker for that expiry. If we think, for instance, that Google will at some point during the day reach a price of 1,133 then we would choose the Call (or above) option which is offering a 321% return rate. Now if at any point during the day the price of Google stock so much as briefly touches that 1,133 level, we would receive our 321% payout. Even if the price falls below that level — or even below our entry-level — prior to expiry we would still receive that same high payout.

Once you reach a ladder “rung,” the return rate associated with that rung is locked-in no matter what happens afterwards. This makes ladder binary options somewhat similar to the more widely known one-touch binary options offered by many popular brokers. Somewhat similar, but also quite different. For one thing, Ladder options can be traded any time markets are open, not just on weekend like one-touch options. The other big difference is the “stepped” nature of the return rate on these contracts as opposed to the single, large payout on a “long-shot” one-touch trade.

Unfortunately, we can’t really get any more in-depth than that regarding these options due to the fact mentioned earlier that each broker who offers them does it somewhat differently. These contracts are so new at this point that they have not yet been standardized across the industry. This will surely happen in time as ladder options continue to gain in popularity. But for now, you will have to consult individual brokers for more detail than that provided here.

Currently the most popular and reliable brokers offering these contracts are:

#1 Finpari – (4.86/5.00) – Gladly Accepts US-Based Traders! (Including ourselves!)

#2 CherryTrade – (4.13/5.00) – Also Happily Accepts US Traders!

#3 TradeRush – (Read Detailed Traderush Review Here) – Sorry…No US Allowed 🙁