Contents

The One-Touch Option – Weekly Options Trading

One-Touch binary options, like Ladder Options, are very different than other common varieties of binary option contracts. For one thing they can only be traded during the weekends when global markets are closed. For another they can have returns that exceed 100%, in some case by quite a lot. The greater the risks you take, the greater your potential rewards will be. These one-touch weekly options contracts have become fairly popular in the last couple years. And they are now being offered by many brokers in the industry. Return rates can vary widely among brokers though so be sure to look at that when considering opening an account.

One-Touch binary options, like Ladder Options, are very different than other common varieties of binary option contracts. For one thing they can only be traded during the weekends when global markets are closed. For another they can have returns that exceed 100%, in some case by quite a lot. The greater the risks you take, the greater your potential rewards will be. These one-touch weekly options contracts have become fairly popular in the last couple years. And they are now being offered by many brokers in the industry. Return rates can vary widely among brokers though so be sure to look at that when considering opening an account.

What Are One-Touch Binary Options?

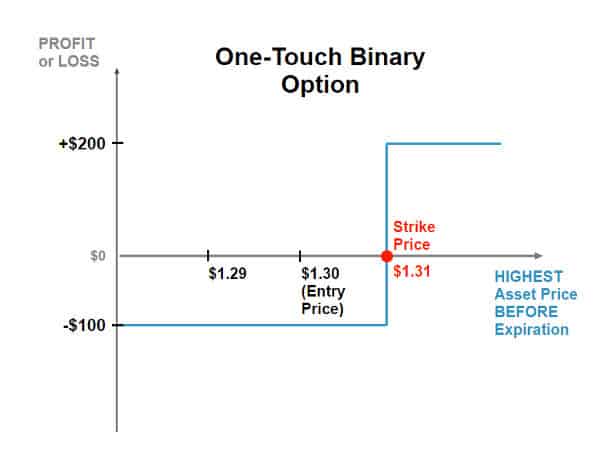

A type of exotic option that gives an investor a payout once the price of the underlying asset reaches or surpasses a predetermined barrier (Source: investopedia.com).

One-touch options are also frequently referred to as “Touch/No Touch” options as well. These options are generally available on weekends only and have an expiry window that runs through the following week. Generally expiring on Fridays at the market close. If your one-touch option gets to that point though then you have lost. This is because if at any time during the week that option were to reach the target level, the contract would be immediately closed out, and your account credited with the profits due you. As far as what those target levels are, that is predetermined by the broker based on market conditions and historical data. Sometimes you are presented with more than one choice of level. But most often your only decisions are the direction (call/put), and the amount to invest.

One-Touch Weekly Options Returns

As you can see from the image above the payouts on these one touch options can be very high indeed. In the case of the shown here (where our personal trading account is) you can find returns as high as 600% in some cases. A maximum return of 500% is more common, but a few other top brokers offers returns up to 600% so just do your homework before jumping in to find the best returns. So now that we know what one-touch binary options are, how do people go about trading them?

How To Trade Weekly Options – One Touch Option Example

Most brokers offer weekly options trading contracts in “units,” of $50 each (though we have seen a couple with $25 units). So clearly the minimum trade amount in these contracts is the cost of one unit, $50 in our example from. The returns offered will be based on market conditions (volatility) and the distance between current and target price.

Luckily, learning how to trade weekly options is a breeze. Lets say that we are bearish on Gold at the moment, and also believe that there is a reasonable chance it goes down to test that $1200 level next week. These beliefs therefore lead us to purchase a put touch option contract for two units = $100 invested. This option will have until next Friday now to reach that target level of just under $1200 USD. Because the gap at the time of purchase is relatively large — at around $50 — the return rate offered is also relatively large at 430%, or $530 on our $100 investment.

If at any point the following week the price of Gold touches that $1190 price level then our trade is ITM. The trade will be automatically closed out by the broker and our account credited with our $530 return. What a deal eh? But if our analysis is wrong and the Gold price never reaches that $1190 mark then the trade is OTM. We would lose our full invested amount. There are no refund rates offered on one-touch binary options. They are truly binary in nature.